DIY Payroll with Excel, Part II

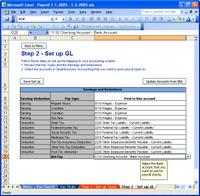

Next up: Setting up the GL mapping for manual payroll in Small Business Accounting. Setting this piece up is pretty straightforward once you know a few basic tips. First, all Earnings should be mapped to Expense accounts and second, all Deductions should be mapped to Liability accounts. If you had an accountant define your Chart of Accounts, you should ask them which accounts to map to which Earnings and Deductions. If you are on your own, click the image to the left for a basic suggested mapping.

Next up: Setting up the GL mapping for manual payroll in Small Business Accounting. Setting this piece up is pretty straightforward once you know a few basic tips. First, all Earnings should be mapped to Expense accounts and second, all Deductions should be mapped to Liability accounts. If you had an accountant define your Chart of Accounts, you should ask them which accounts to map to which Earnings and Deductions. If you are on your own, click the image to the left for a basic suggested mapping.If you need to add new accounts to complete this step, toggle back to SBA, add the account and toggle back to Excel. Click the Update Accounts from SBA button to ensure the latest accounts show up. When you are satisfied with both the Tax and GL setup steps, click the Save Set up button to save all of the information you entered. Note, this setup is saved to a separate template file that is used every time you click the Enter Manual Payroll menu item from within SBA, and it can always be updated and re-saved, as with this first payroll run.

After setup is complete for both taxes and the GL, it's time to enter the details for the payroll period you entered when Excel first opened.

More on entering payroll in the next post...

0 Comments:

Post a Comment

<< Home